Reduce Exploration Drilling Costs by 40–60% Through Pre-Drill Geophysical Targeting

Every blind drill hole is money lost. A geophysical survey costs a fraction of a single drill hole — and can eliminate the holes that would never have intersected anything. We give you coordinates, depth estimates, and priority rankings before you spend your drilling budget.

The Economics of Blind Drilling

Most exploration programs drill too many holes in too many places because the targeting is based on surface geology alone. Geophysics changes the equation.

- Drill collars placed on geological inference only

- 30–60% of holes miss the target entirely

- Reserve calculation requires systematic grid drilling

- Satellite bodies and secondary zones missed completely

- Program extended to cover uncertainty — more holes, more cost

- Discovery of unfavorable geology (faults, weak zones) only after drilling

- Drill collars placed on confirmed anomaly positions with depth estimates

- Intersection rate increases significantly — fewer wasted holes

- Reserve calculation guided by 2D sections — fewer confirmation holes needed

- Satellite and adjacent bodies identified before drilling begins

- Program scoped to priority targets — tighter, faster, cheaper

- Unfavorable geology flagged pre-drill — program cancelled or redesigned before spending

Where the Savings Come From

Six specific mechanisms — each with a measurable impact on your exploration budget.

Drill Hole Elimination

Targets that show no electromagnetic anomaly and no structural control are removed from the drill program before a single metre is drilled. In a 10-hole program, eliminating 3–4 holes at $50–200/m can save $150,000–$500,000 depending on depth and terrain.

Improved Hole Angle & Inclination

The electromagnetic section shows the dip and geometry of the target body. Drilling at the optimal angle to intersect the body maximizes core recovery and minimizes the metres needed to confirm the target — reducing cost per useful metre significantly.

Depth Optimization

Pre-drill depth estimates prevent over-drilling — stopping at the target rather than drilling to an arbitrary depth. A 20% reduction in average hole depth across a 10-hole program has an immediate and direct cost impact.

Satellite Body Discovery

The Loza system frequently identifies secondary conductive bodies adjacent to the main target — bodies that would not be detected without geophysics. Including these in reserve calculations can materially change project economics without additional drilling.

Early Program Termination

If the geophysical survey shows no anomaly consistent with economic mineralization, the drill program can be cancelled before committing the full budget. This is the most valuable scenario: the survey cost is the cost of a correct decision.

Infrastructure Risk Avoidance

For reservoir, dam, and infrastructure projects: identifying active faults, weak zones, or karst before construction begins can prevent project cancellation costs orders of magnitude larger than the survey cost.

Case Study: Reservoir Site Investigation — Fault Detected Pre-Construction

This project illustrates the highest-value scenario: a survey that stops a project before irreversible money is spent.

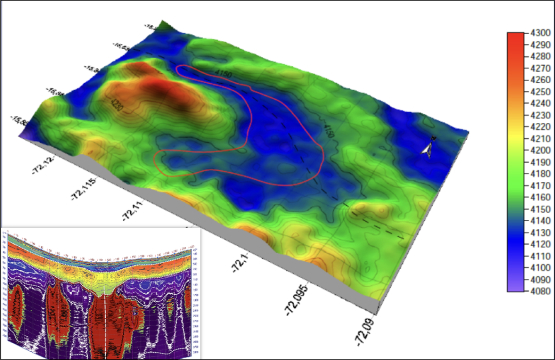

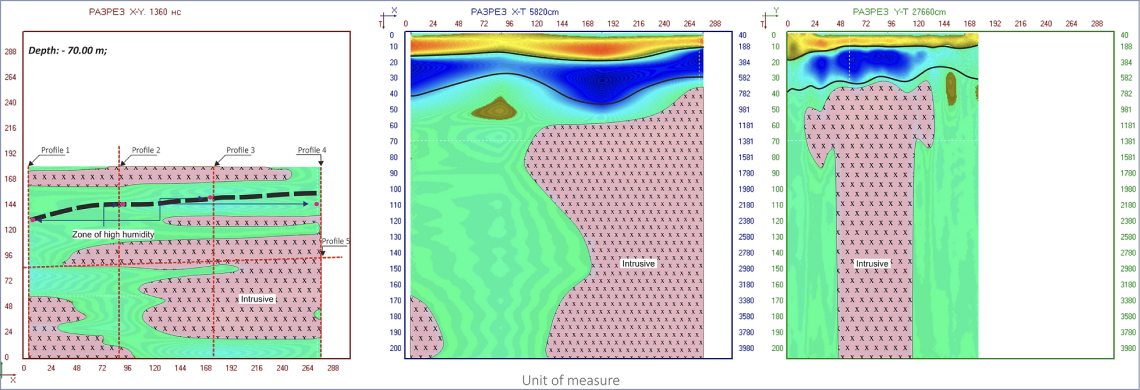

Site investigation for reservoir construction. The objective was to identify tectonic disturbances and map the contact zone between sedimentary cover and bedrock — standard pre-construction geotechnical scope.

Electromagnetic profiling mapped a fault running along the entire length of the proposed reservoir footprint. Subsequent geological interpretation confirmed the fault is active. The project in its original form was not viable — construction would have proceeded onto an active fault.

The project was stopped before construction began. The cost of the electromagnetic survey was negligible compared to the cost of building on an active fault — or discovering the fault after construction. Monitoring continues. The site is under ongoing investigation for a redesigned approach.

Value delivered: entire construction budget protected.

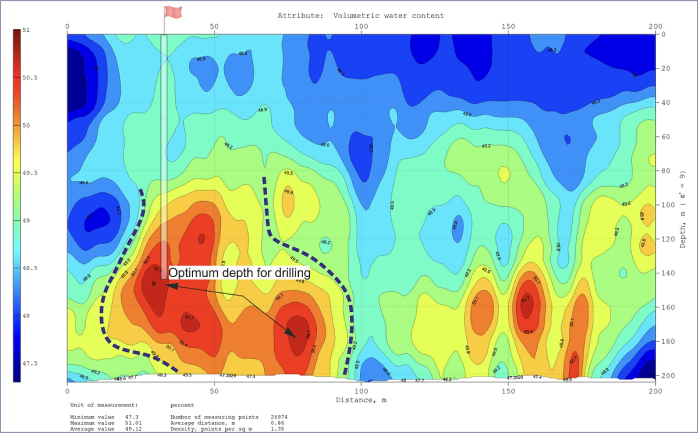

Case Study: Optimal Well Positioning — Groundwater Program

Pre-drill electromagnetic targeting applied to a groundwater program — maximizing yield per hole drilled.

Having the exact coordinates and depth of the target before drilling, cost calculation becomes straightforward — and the result predictable. Guesswork is eliminated from the budget.

The Survey vs. Drilling Cost Comparison

These are approximate figures for context — actual costs depend on terrain, depth, and location. The ratio is what matters.

Cost Reduction — Frequently Asked Questions

How much can geophysics actually reduce my drilling costs?

The reduction depends on how many holes your current program would drill without geophysical guidance, and what percentage of those are targeting poorly constrained positions. In programs where 30–50% of holes miss the target, systematic pre-drill geophysics has been shown to reduce total drilling cost by 30–60% while improving the intersection rate. We can assess your specific program during a scoping call.

What if the survey shows nothing — is that money wasted?

No. A negative result is one of the most valuable outcomes a survey can deliver. If the electromagnetic survey shows no anomaly consistent with economic mineralization at your target, you have avoided drilling a program that would not have found anything. The survey cost is the cost of a correct decision made early — before the drilling budget is committed.

At what stage of exploration is geophysics most cost-effective?

Pre-drill — before any holes are collared. The earlier geophysics is applied, the greater the cost impact. Reconnaissance surveys over large areas identify the priority zones before any detailed work begins. Detail surveys over selected targets refine drill collar positions and angles before the rig arrives. Both stages reduce cost, but the earlier the better.

Can geophysics replace geological mapping in a cost reduction program?

No — and it should not. The highest cost reduction comes from combining both: geological mapping identifies structural controls and host lithologies, geophysics resolves which structures carry anomalies worth drilling. Using geophysics without geological context can misinterpret results; using geology without geophysics leaves subsurface targets unresolved. Our consulting service integrates both.

How quickly can a survey be completed and results delivered?

For a typical pre-drill detail survey (10–50 line-km), field acquisition takes 3–10 days. Processing and interpretation adds 5–10 days. Total turnaround from mobilization to drill-ready report: typically 3–5 weeks. For reconnaissance programs over larger areas, timelines scale with survey extent.